I’m going to start this blog post with a disclaimer. I’m a complete work in progress in this department BUT I’ll teach you what I know from the school of hard knocks. . .

And if you’ve missed the previous blogs in this series than stop reading. Click here to learn the emotion that will strengthen your resolve and here for the secret to sticking with your commitments and totally transforming your life.

Financial peace is a key to longevity.

From “The Millionaire Next Door” and “The Wealthy Barber” there are thousands, likely millions of pages written on finances.

But reading a book is not enough to get a firm grip on our financial situation. Especially when it seems money is flying out the door faster than we can cash our paycheques. But the key is, where is it really going?

[ctt tweet=”Money is flying out the door faster than we can cash our paycheques. — Dr. Jenkins” coverup=”85Qoh”]

A recent report[ref]http://www.theglobeandmail.com/globe-investor/personal-finance/household-finances/canadian-households-still-adding-debt-but-pace-slowing-equifax/article26366796/[/ref] says since the start of the year, consumers have been drawing down their savings to buy houses, cars, furniture and clothing.

Credit-card spending rose by 8 per cent this year, with spending on restaurants and fast food up more than 12 per cent, according to a study by payment processor Moneris Solutions Corp.

Auto loans rose nearly 4 per cent in the second quarter on the back of record vehicle sales, credit rating agency Equifax found.

Did you see the list? Houses, cars, furniture and clothing. . . .and eating out.

These are not things our grandparents would have gone in debt for. A home, yes, but the rest of the list? I don’t think so.

So here are some practical steps that my family has done to allow us to live comfortably but still keep our priorities straight.

Do life without a car payment

This is harder than you think but when we were first married our new car was a lease, we just didn’t have the credit rating or the money up front to purchase. But that was the first and the last. We buy quality vehicles but we also keep it for a long time. Most of our vehicles are paid off in 3 years and we keep them for 10. That makes for 7 years without a payment. And we generally by used, unless we can’t find the quality and model we want, then we will buy new.

Pay off your credit cards each month

I know there are lots of financial experts out there that say to cut up your credit cards and that would be awesome but as a busy family we have lots of monthly expenses that we put on automatic credit card payment just to get rid of the stress of thinking about it. Sometimes it get’s a bit stressful if there are some unexpected expenses in the month but we’ve only had a couple times in our married life where we couldn’t pay off our credit card purchases at the end of the month. The other credit card recommendation is make sure you have a card that the rewards are something that you would actually spend money on. For years we had cards where we got reward items that were just luxuries and we didn’t really need the “stuff” we received for rewards. We now have a companion flight card that we use for visiting family back in Ontario each year. That’s practical and it is money we don’t need to spend.

Try your best to have a budget

Again a common recommendation BUT not easy. And most of the people we know that live life on a strict budget are not very happy. Yes, have a budget, be aware of how much things cost, BUT if you are so budget aware that you are stressed out and joyless then it’s really not serving you.

Live within your means

That mean’s don’t spend more than you make. There are months that we blow it and have to borrow on a line of credit, but the next month we are working towards paying that off. That pay down becomes our top priority and we go without other things in order to get that under control. According to the Financial Post[ref]http://business.financialpost.com/personal-finance/debt/canada-household-debt-ratio-hits-new-record-of-163-3[/ref] the average Canadian “household debt to disposable income” ratio is now an all time high of 163%. Ask your accountant, but I think that means that if you’re over 100% your math isn’t working for you. You are living beyond your means.

Be ok with not keeping up with the neighbours

We are fortunate to live in a really nice neighbourhood. The problem is that there are constantly new car’s in the driveway’s, home and landscaping renovations happening and the furniture delivery truck is in our neighbourhood on a regular basis. Our neighbour’s kids are sporting the latest iPhone’s and fashions. . . and even though we see this stuff, we constantly remind ourselves that many of those purchases are made on credit and really don’t belong to those people. They belong to the bank. And if it’s a situation where those neighbours make more money that we do then congrats for them, we’re glad they’re are enjoying their money and purchases, that’s what money is for. . . to be enjoyed.

Work really, really hard

Work ethic and the joy of a hard day’s work seems like a logical thing but seemingly I am bumping into people that want to get paid lots of money, have lots of really nice things but “mail it in” when it comes to work.

Do work that brings you joy

My wife went to university and got a nursing degree. She worked while I finished up chiropractic school and fortunately it was a great income, but she really didn’t enjoy it. She loves music. So when it came time for her to return to work, she decided to teach piano out of our home and in an after school program. Would nursing pay more? Yes. Would it bring her joy? No. So the better option is for her to do something that brings her joy rather than a big income.

Prioritize what really matters most

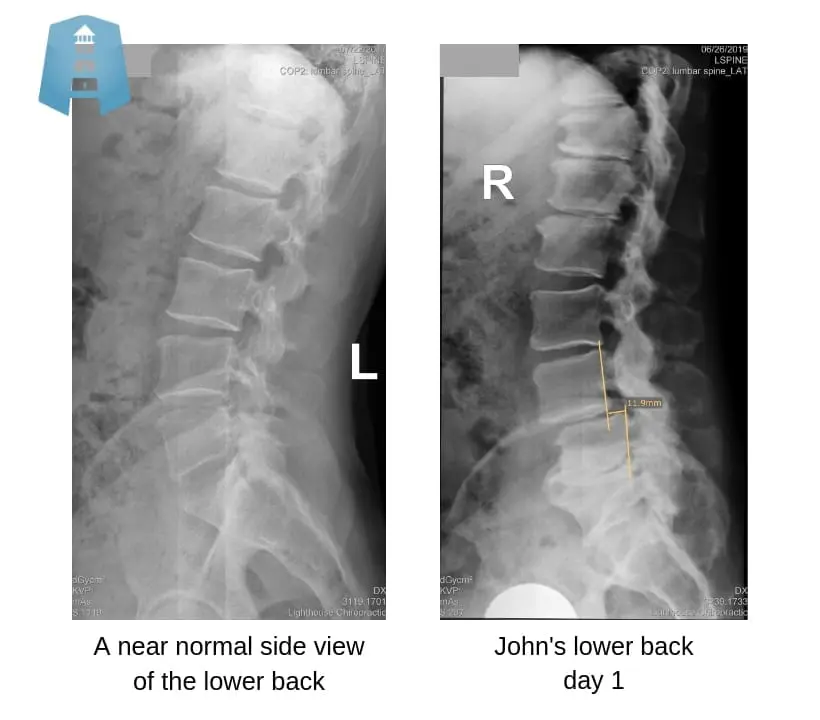

This one is a no brainier to me but you need to know what you want to spend your money on. Unless you have unlimited resources, you only have the ability to purchase what you need and sometimes what you “want”. I can’t tell you the number of conversations I’ve had with really successful people that just spend money randomly. Splurge spending to satisfy a temporary want but really are missing out on the things that they really need. Take health care, like chiropractic or a gym membership or quality workout gear. How about better quality food or essential supplements? These things may seem like a small things in all life’s expenses but if you don’t plan on having the money for those things then your quality and length of life will suffer. A surround sound or new ski jacket won’t keep you out of the hospital if you’ve ignored your health. Today’s health care system pays for crisis and trauma but not health care. . . .if you don’t plan that in your basic life needs then you will be stuck with the same results that everybody else is dealing with. Diabetes, depression, cancer and heart disease are all on the rise, not to mention arthritic conditions and spinal disorders that are eroding your health. This needs to be attended to and if we don’t plan it into our finances we will regret it. It is the best investment in your future that you can make.

Do we really need to do a major vacation every year or two?

This is a good question, and not an easy one to answer BUT if you are heading south to beat your stress BUT you can’t afford quality food and chiropractic care, think again. Yes, it’s awesome that there are some people that seem to be able to “do it all” based on their income or inheritance BUT that is not where most of us are at. Going to Cabo San Lucas or Hawaii but avoiding the dentist and saying you can’t afford healthier food because it’s too expensive is messed up. Remember where we live. The world travels to Kelowna, the Okanagan and British Columbia, we are not going without if we do a “stay” vacation. The problem again comes when we look at our neighbours and start comparing. I can guarantee you if you had some of the “people who vacation all the time” credit card balances, you’d loose sleep at night. Get creative, ask around, find out how you can create amazing memories in our own back yard.

Life without regrets.

I know a list like this seems like a real downer but to realize how important this is, all you need to do is chart out where many Canadian’s are going to be in 15 or 20 years if they don’t change their current strategies.

The idea of a reverse mortgage, not being able to retire or returning to work after retirement because of consumer debt does not lead to a successful 100+Living life. But that’s where many Canadian’s are headed.

We’re not perfect.

As I mentioned, my family and I are not perfect and we have a long way to go but if you can move towards some of the points that are working for us I know it will do amazing things for your health and stress too.

Let the “buyer’s remorse” be for other people.

Yes this list will have you driving an older car, but at least you’ll own it:) Your Facebook page may not have pictures from across the globe but I still think you can create some pretty amazing photo albums in BC (actually just about anywhere in Canada), until you can actually afford a foreign travel vacation.

But isn’t it more fun being on vacation and not worrying about how much “dinner is costing you” because you have a stable financial foundation?

[ctt tweet=”I can 100% guarantee there is no one on the planet that regretted investing in their health. — Dr. Jenkins” coverup=”eN64m”]

And I can 100% guarantee that there is no one on the planet that has regretted investing in their health. Especially when so many seniors are wasting away their last decade of life in sickness and disease.

Live life to the full and make sure you keep your priorities straight, I dare you to stop living the life the “mass marketing machine” is telling you you want, I know you’ll be glad you did.

Everybody needs a wise mentor.

I really believe that your best health and lifestyle mentor is a great chiropractor. Today’s chiropractic is all about a balanced, practical approach to life.

[ctt tweet=”I believe your best health and lifestyle mentor is a great chiropractor. — Dr. Jenkins” coverup=”_0iVY”]

If you are having trouble finding a chiropractor in your area that specializes in what we talk about in our blog then connect with us.

Leave a comment below or contact us at our office (250-870-9136) and we’ll try our best to connect you with a chiropractor in your area that does corrective work and freely offers the “added value” advice and insight that we all need if we are going to life a long and healthy life.

For 120 years our profession has lead the way in common sense health solutions. We’d love to get you connected with a doc that will help you live the 100+Living Plan.

1 Comment.

life-changing article. thanks for sharing this